Click to Preview

Tips For Using Form W-4

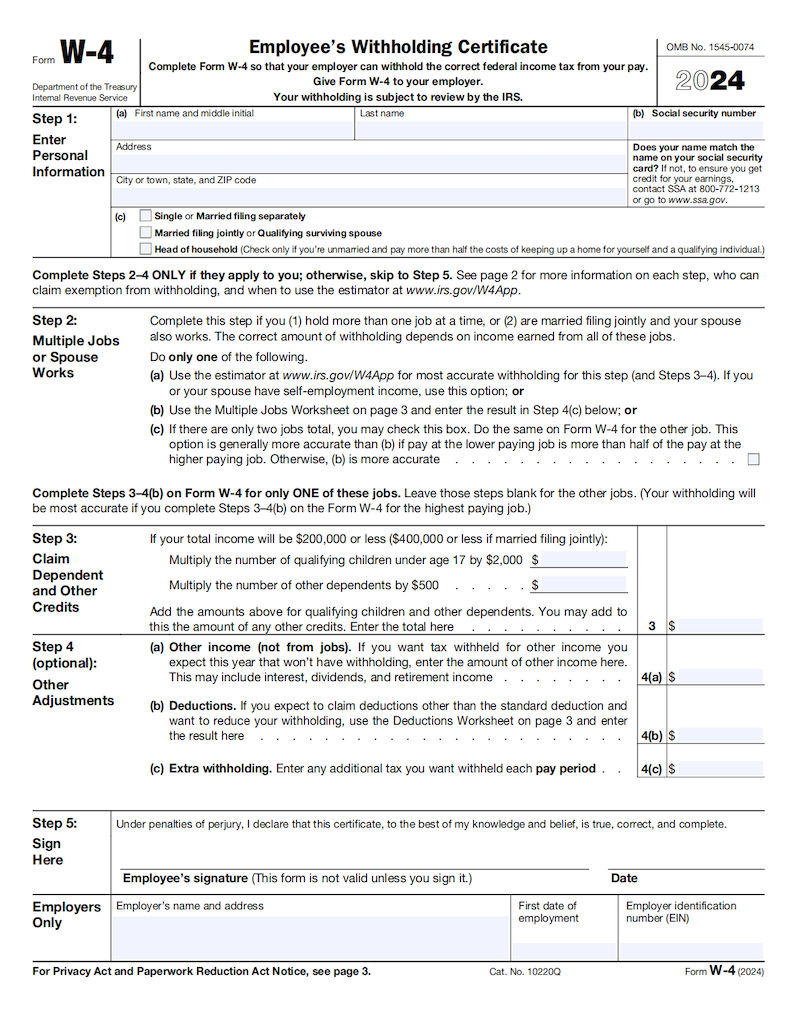

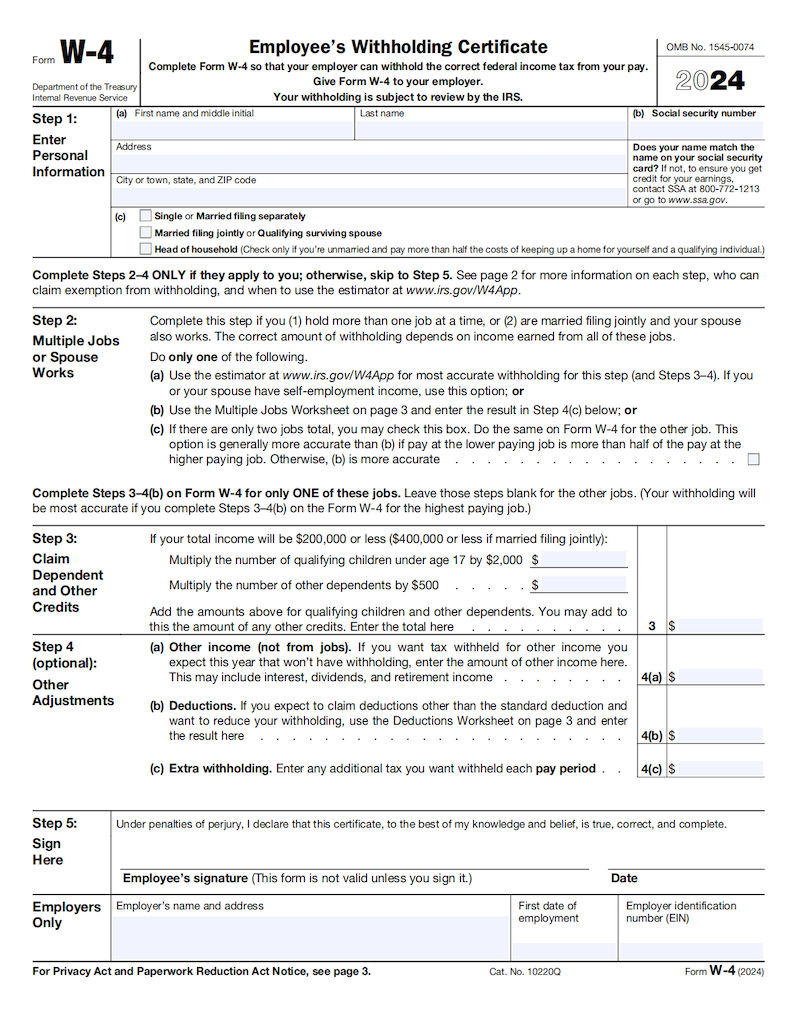

- 1. Completing Form W-4Fill out your Form W-4 accurately by providing your personal information, including your name, address, Social Security number, and filing status. Choose your withholding allowances carefully.

- 2. Understanding WithholdingBe aware of how your withholding affects your tax liability. Adjust your Form W-4 if necessary to ensure the right amount is withheld from your paycheck to cover your tax obligations.

- 3. Updating Form W-4Review and update your Form W-4 whenever your personal or financial situation changes, such as getting married, having a child, or starting a new job. Keeping your form current helps you avoid under or over-withholding.

Find IRS Offices Near Me

-

Alabama6 Offices

-

Alaska2 Offices

-

Arizona9 Offices

-

Arkansas3 Offices

-

California28 Offices

-

Colorado4 Offices

-

Connecticut7 Offices

-

Delaware2 Offices

-

Florida18 Offices

-

Georgia11 Offices

-

Hawaii3 Offices

-

Idaho4 Offices

-

Illinois12 Offices

-

Indiana9 Offices

-

Iowa6 Offices

-

Kansas3 Offices

-

Kentucky7 Offices

-

Louisiana8 Offices

-

Maine4 Offices

-

Maryland8 Offices

-

Massachusetts8 Offices

-

Michigan6 Offices

-

Minnesota6 Offices

-

Mississippi5 Offices

-

Missouri10 Offices

-

Montana6 Offices

-

Nebraska4 Offices

-

Nevada2 Offices

-

New Hampshire4 Offices

-

New Jersey12 Offices

-

New Mexico4 Offices

-

New York24 Offices

-

North Carolina9 Offices

-

North Dakota4 Offices

-

Ohio11 Offices

-

Oklahoma4 Offices

-

Oregon5 Offices

-

Pennsylvania20 Offices

-

Rhode Island2 Offices

-

South Carolina4 Offices

-

South Dakota3 Offices

-

Tennessee6 Offices

-

Texas25 Offices

-

Utah4 Offices

-

Vermont4 Offices

-

Virginia11 Offices

-

Washington11 Offices

-

West Virginia7 Offices

-

Wisconsin7 Offices

-

Wyoming3 Offices