Click to Preview

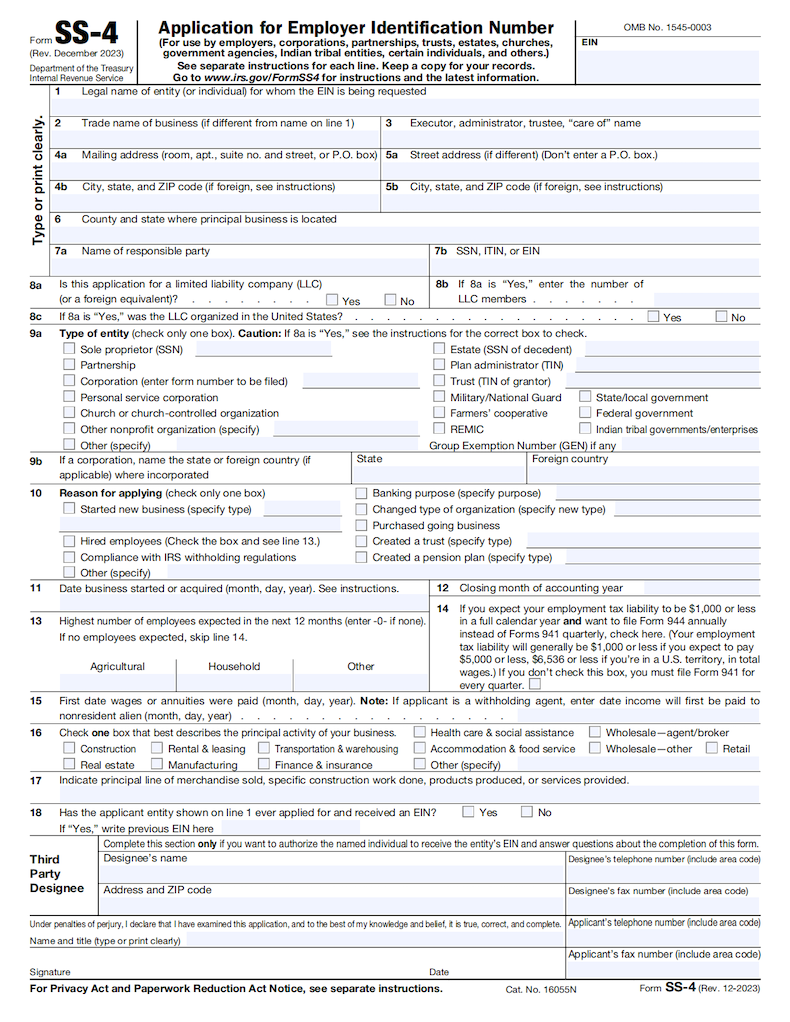

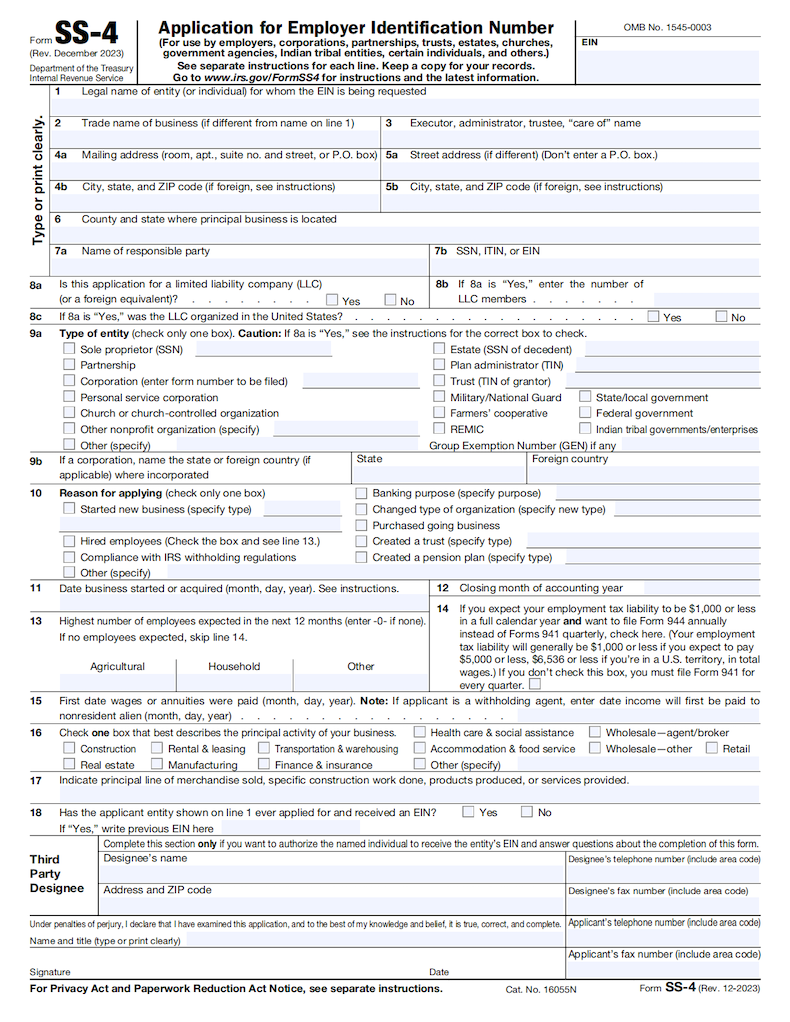

Tips For Using Form SS-4

- 1. Completing Form SS-4Provide accurate information about your business entity, including legal name, address, and EIN. Specify the type of entity and the reason for applying for an EIN on Form SS-4.

- 2. Understanding EIN ApplicationKnow the purpose of an Employer Identification Number (EIN) and its necessity for tax reporting and business identification. Ensure the information provided on Form SS-4 is correct.

- 3. Submitting Form SS-4File Form SS-4 with the IRS either online, by mail, or by fax. Double-check all details before submission to avoid delays in receiving your EIN. Keep a copy of the form for your records.

Find IRS Offices Near Me

-

Alabama6 Offices

-

Alaska2 Offices

-

Arizona9 Offices

-

Arkansas3 Offices

-

California28 Offices

-

Colorado4 Offices

-

Connecticut7 Offices

-

Delaware2 Offices

-

Florida18 Offices

-

Georgia11 Offices

-

Hawaii3 Offices

-

Idaho4 Offices

-

Illinois12 Offices

-

Indiana9 Offices

-

Iowa6 Offices

-

Kansas3 Offices

-

Kentucky7 Offices

-

Louisiana8 Offices

-

Maine4 Offices

-

Maryland8 Offices

-

Massachusetts8 Offices

-

Michigan6 Offices

-

Minnesota6 Offices

-

Mississippi5 Offices

-

Missouri10 Offices

-

Montana6 Offices

-

Nebraska4 Offices

-

Nevada2 Offices

-

New Hampshire4 Offices

-

New Jersey12 Offices

-

New Mexico4 Offices

-

New York24 Offices

-

North Carolina9 Offices

-

North Dakota4 Offices

-

Ohio11 Offices

-

Oklahoma4 Offices

-

Oregon5 Offices

-

Pennsylvania20 Offices

-

Rhode Island2 Offices

-

South Carolina4 Offices

-

South Dakota3 Offices

-

Tennessee6 Offices

-

Texas25 Offices

-

Utah4 Offices

-

Vermont4 Offices

-

Virginia11 Offices

-

Washington11 Offices

-

West Virginia7 Offices

-

Wisconsin7 Offices

-

Wyoming3 Offices