Click to Preview

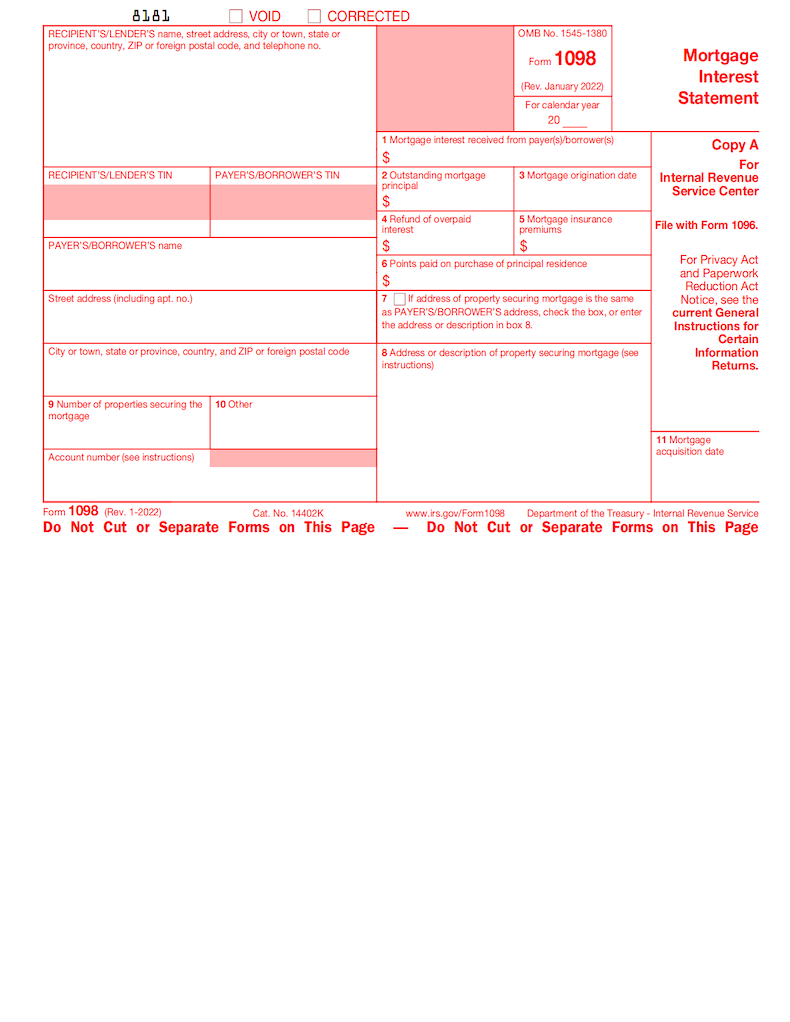

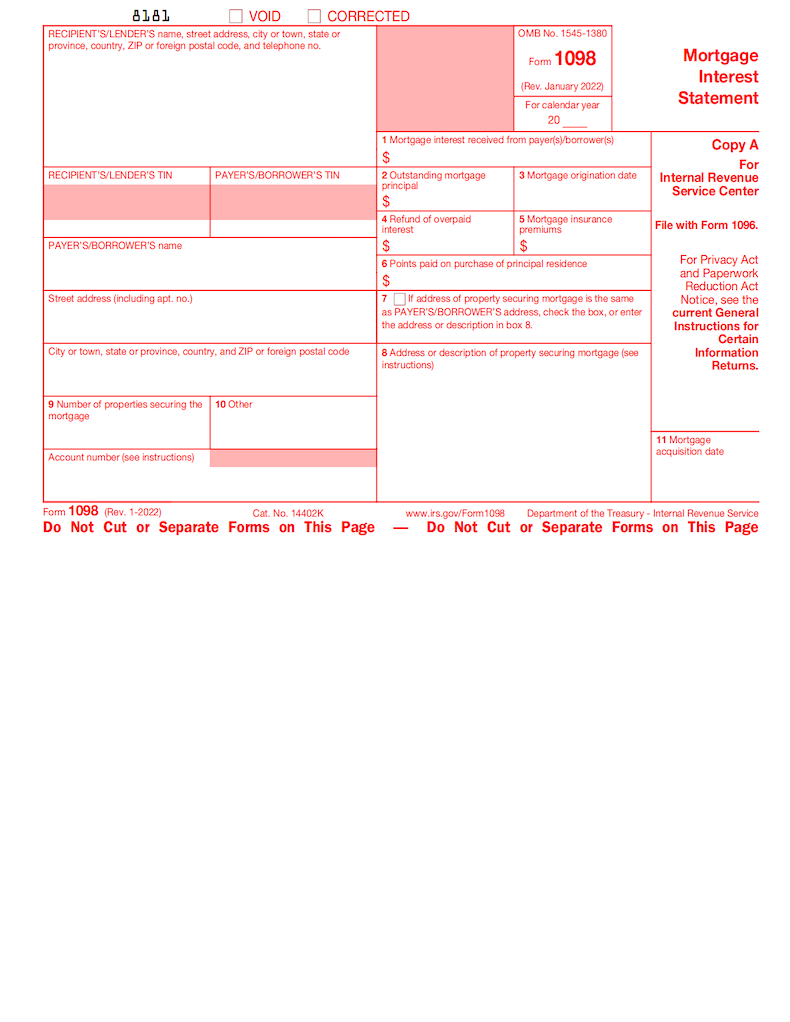

Tips For Using Form 1098

- 1. Filling Out Form 1098Provide accurate details about mortgage interest paid, property taxes, and mortgage insurance premiums. Ensure the information matches your records and those of your lender.

- 2. Understanding Tax DeductionsKnow the tax implications of the information on Form 1098. Understand how mortgage interest, property taxes, and mortgage insurance premiums affect your tax deductions and liabilities.

- 3. Updating Form 1098Verify the information provided by your lender on Form 1098 for accuracy. If there are discrepancies, communicate with your lender to update the form before filing your taxes.

Find IRS Offices Near Me

-

Alabama6 Offices

-

Alaska2 Offices

-

Arizona9 Offices

-

Arkansas3 Offices

-

California28 Offices

-

Colorado4 Offices

-

Connecticut7 Offices

-

Delaware2 Offices

-

Florida18 Offices

-

Georgia11 Offices

-

Hawaii3 Offices

-

Idaho4 Offices

-

Illinois12 Offices

-

Indiana9 Offices

-

Iowa6 Offices

-

Kansas3 Offices

-

Kentucky7 Offices

-

Louisiana8 Offices

-

Maine4 Offices

-

Maryland8 Offices

-

Massachusetts8 Offices

-

Michigan6 Offices

-

Minnesota6 Offices

-

Mississippi5 Offices

-

Missouri10 Offices

-

Montana6 Offices

-

Nebraska4 Offices

-

Nevada2 Offices

-

New Hampshire4 Offices

-

New Jersey12 Offices

-

New Mexico4 Offices

-

New York24 Offices

-

North Carolina9 Offices

-

North Dakota4 Offices

-

Ohio11 Offices

-

Oklahoma4 Offices

-

Oregon5 Offices

-

Pennsylvania20 Offices

-

Rhode Island2 Offices

-

South Carolina4 Offices

-

South Dakota3 Offices

-

Tennessee6 Offices

-

Texas25 Offices

-

Utah4 Offices

-

Vermont4 Offices

-

Virginia11 Offices

-

Washington11 Offices

-

West Virginia7 Offices

-

Wisconsin7 Offices

-

Wyoming3 Offices